据劳氏日报(Lloyd’s List)报道,中远海将以60亿美元的价格收购OOIL,这个价格高于此前华尔街日报报道的40亿美元。

劳氏日报最新报道

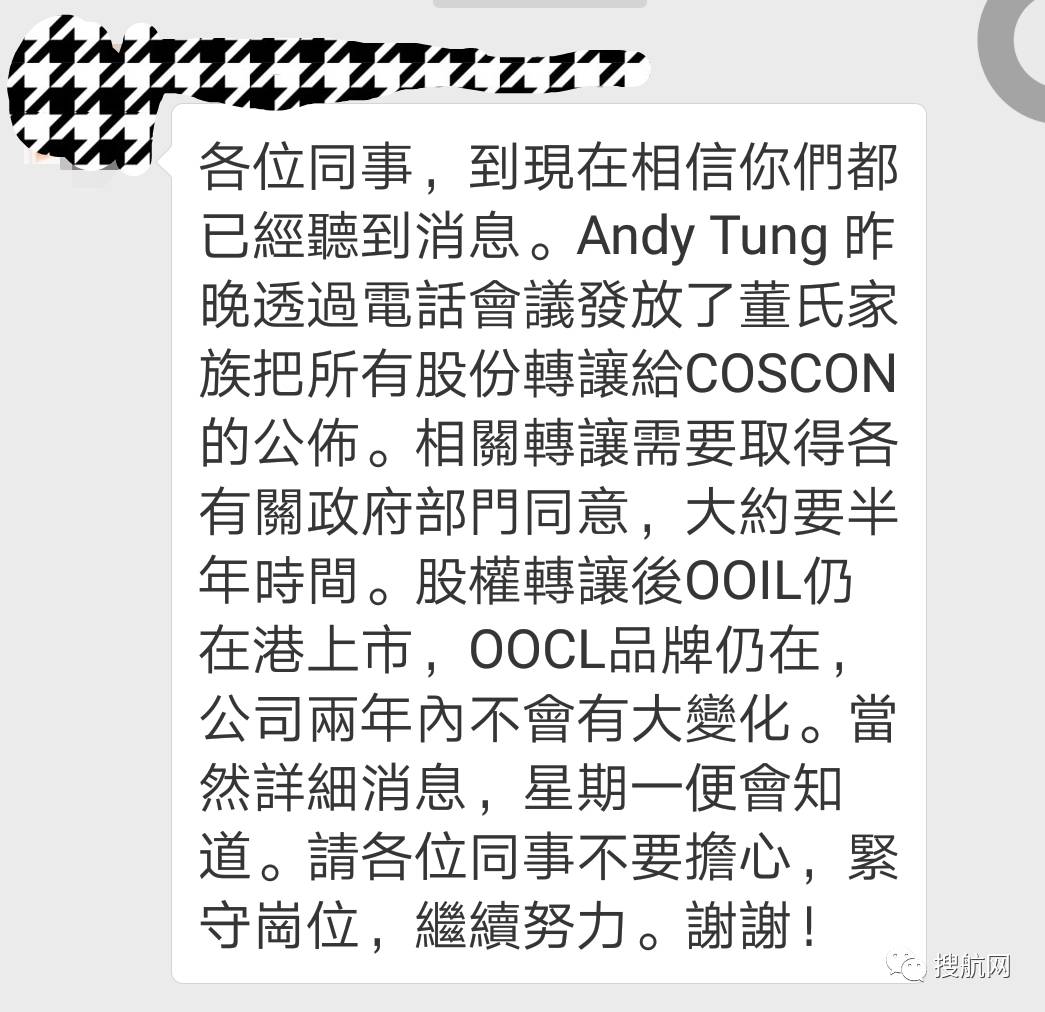

劳氏日报也留意到了一封流传的OOIL管理层发给员工的消息,消息提到董氏家族将会把所有的股份转让给中远海,OOIL仍会在香港上市,OOCL的品牌也还会保留,两年内不会有大变化,而收购需要相关政府部门同意,大约要半年的时间。

搜航网友提供

劳氏日报联系了OOIL的一位高层管理人员,他表示知道相关的谈话,但无法确认该消息的真实性。

而一位知情人士向劳氏日报透露,本次收购可能是收购OOIL的全部股份,总价将会超过60亿美元。

中远海在香港和上海都有上市,但至5月17日起,其在上海证券交易所的股票交易就已经停牌,中远海表示公司正在筹划重大事项。

此次收购将成为航运业的又一重大收购行动,船公司似乎越来越重视规模经济,每家船公司都在不断的升级整合水平。

近期船公司间的整合就包括,CMA收购NOL,马士基收购汉堡南美,赫伯罗特收购UASC,日本三家船公司整合旗下集装箱业务。

据Alphaliner的统计,如果此次交易完成,中远海的总运力将提高到240万TEU,超过CMA成为世界第三大的船公司。

而随着两家公司新船订单的交付,还将进一步提高到约310万TEU,仅落后排名第二的MSC 20万TEU,目前MSC加上新船订单的运力约为330万。

中远海进入前三,也打破了此前前三的船公司都是欧洲公司的局面,而其也将取代CMA成为海洋联盟中最大的船公司。

而中远海从此次收购中不只能获得运力的提升,OOCL一直被认为是运营得最好的船公司之一,中远海可以从OOCL较为西化的业务理念中获益不小。

近期,中远海也在不断地收购全球各地的港口,而OOCL在美国长滩拥有一个港口,收购完成后,中远海的全球港口布局也能得到进一步的加强。

劳氏日报预计,航运业还会进一步的进行整合,而到目前为止,除了MSC以外,大多数的主要船公司都进行了整合。不过颇具讽刺意味的是,在航运业最困难的2016年,据劳氏日报统计,最好业绩的船公司是MSC。

MSC更倾向于通过购买船舶来增强竞争力,而不是通过收购,这也可以避免整合初期出现的动荡局面。

劳氏日报也表示,OOCL的客户习惯于顶尖的服务水平,别的船公司或许会趁着中远海与OOCL整合初期的不稳定,吸引他们的客户使用自己的运输服务。

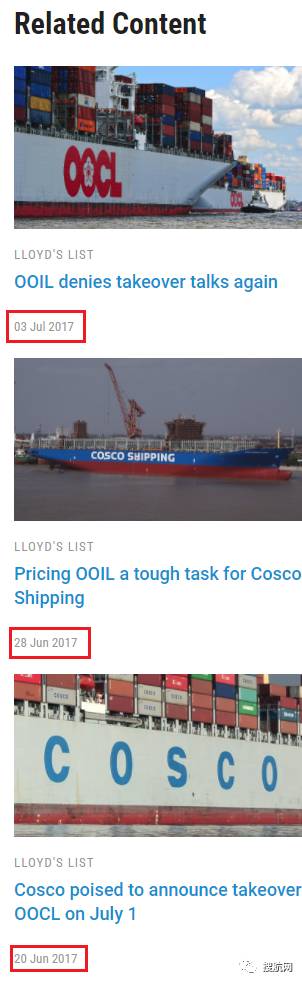

尽管两家公司一再否认,收购的消息自去年底开始就一直在业内流传。而消息传出后,OOIL的股价也是一路猛涨,在周五(7月7日)收市时股价为60元港币,比年初时猛涨了78%之多。

外媒已经多次报道过关于中远海收购OOCL的消息:

华尔街日报1月报道

劳氏日报此前报道

最后附上劳氏日报报道原文:

The $6bn deal would mark yet another major acquisition move in the liner shipping industry and push Cosco Shipping into the top three

SPECULATION is rife that China Cosco Shipping Group has finally inked an agreement to acquire Orient Overseas (International) Ltd, with an official announcement expected by Monday.

A message, thought to have been sent by OOIL management to its staff, has been circulating on Chinese social media over the weekend. It said the company’s chief executive Andy Tung, whose family controls 69% of Hong Kong-listed OOIL, confirmed via an internal conference call on Friday that the family had agreed to sell all its shares to Cosco Shipping.

“It will take about half year for the transaction go through government approvals, after which OOIL will remain listed in Hong Kong, " the massage said, adding the company's container shipping outfit OOCL will keep its trade mark and brand.

The Hong Kong-based company will see no major changes within two years, the message continued. “More details would be revealed on Monday.”

When approached by Lloyd’s List, an OOIL executive said he was aware of the talks, but unable to confirm the authenticity of the message.

Lloyd's List was told by separate sources that the acquisition was likely to be the entire equity of OOIL and could be worth more than $6bn.

An exchange filing from Shanghai-and Hong Kong-listed Cosco Shipping Holdings, the container shipping and port outfit of the Chinese conglomerate, could be expected to come by Monday morning.

Share trading of the CSH has been halted at the Shanghai Stock Exchange since May 17, when the company made an initial disclosure that its parent was planning a major event.

The long-waited deal, if it materialises, will mark yet another major acquisition move in an industry where economies of scale appears to have become increasingly crucial for each carrier’s survival with an escalating level of consolidation.

Maersk Line is in the process of acquiring Hamburg Süd for $4bn, following CMA CGM’s purchase of NOL last year for $2.5bn. The three Japanese shipping giants--NYK, MOL and K Line--have also just established a joint venture business to merger their container shipping and overseas port operations.

The transaction, assuming it goes through, will boost the Chinese carrier’s fleet capacity to 2.4m teu, outstripping its Ocean Alliance partner CMA CGM and becoming the world’s third-largest carrier, according to Alphaliner statistics.

With the orderbook included, the merged fleet capacity would increase to 3.1m teu, trailing just behind Mediterranean Shipping Co’s 3.3m teu.

The reorganisation in capacity will change the balance of power within the container shipping industry, with the top three carriers no longer all European. It will also shift dynamics within the Ocean Alliance, where CMA CGM is currently the largest member.

But while scale matters, Cosco Shipping will gain more than just capacity. OOCL is regarded as one of the best run container lines in the business. While there should be fewer clashes of corporate culture than if Cosco has succeeded in its tentative bid for Hamburg Süd last year, the Chinese carrier should benefit from OOCL’s westernised business disciplines.

The Cosco group is undoubtedly on the march, buying terminal assets as well as expanding its container operations, first through the merger with China Shipping, and now the bid for OOIL. The deal will also add to Cosco’s port interests, with OOCL owning the concession for the state-of-the art Long Beach Container Terminal in southern California. That in turn will add to further pressure to consolidate terminal operations in the LA/Long Beach complex where alliance partners Evergreen and CMA CGM each have separate facilities, as does Cosco.

More immediately, though, this takeover – assuming it goes through – will add to further concentration in the container shipping industry that has involved just about every major carrier, with the exception of Mediterranean Shipping Co. But none of this will make any sense unless the industry can produce decent financial returned. And yet ironically, the line that probably achieved the best results during a difficult 2016 was MSC, which prefers to grow through ship purchases rather than corporate acquisitions, so avoiding all the pitfalls of trying to integrate another company, while picking up new business during the inevitable upheaval of the amalgamation process.

OOCL customers are used to a tip-top service. All the other carriers will be trying to woo them as Cosco and OOIL embark on what is likely to be a tricky and sensitive takeover of one of container shipping’s top names.

Speculations over the deal had been swirling around the market since late last year, despite repeated denials from the two companies.

Last month, Lloyd’s List was told by a banking source close to Cosco Shipping that the acquisition discussions were real, although pricing OOIL was a tough task for the state-owned giant. The source suggested by then that a takeover at a premium against the book value of OOIL would be difficult.

Management of OOIL later denied the takeover talks during the recent Daiwa Auto & Industrials Leaders Conference, but adding a sale is only possible if a buyer is willing pay at a very attractive price in cash.

OOIL’s share price closed at HK$60 on Friday, a 78% surge from the beginning of this year.

往期导读:

❷头条丨马士基之后又一家国际物流巨头系统瘫痪,整个航运物流界陷入恐慌!

❸近期外汇入账后无法正常提取情况频发,广大外贸和货代企业需要特别关注